In recent years, the finance landscape has undergone a seismic shift with the rise of cryptocurrencies. Once considered a niche interest, crypto has now become a mainstream phenomenon, attracting the attention of students on college campuses worldwide. As digital currencies like Bitcoin, Ethereum, and others continue to capture headlines and intrigue, it's vital to assess the impact of crypto on student finances and understand how universities can support their students in navigating this new financial frontier.

The Student Crypto Experience

Across college campuses, students are increasingly drawn to cryptocurrencies for various reasons. For some, it's the allure of potentially lucrative returns, while for others it represents a means of financial independence and empowerment outside traditional banking systems. The accessibility of crypto trading platforms and the proliferation of online resources have further facilitated student engagement with digital assets.

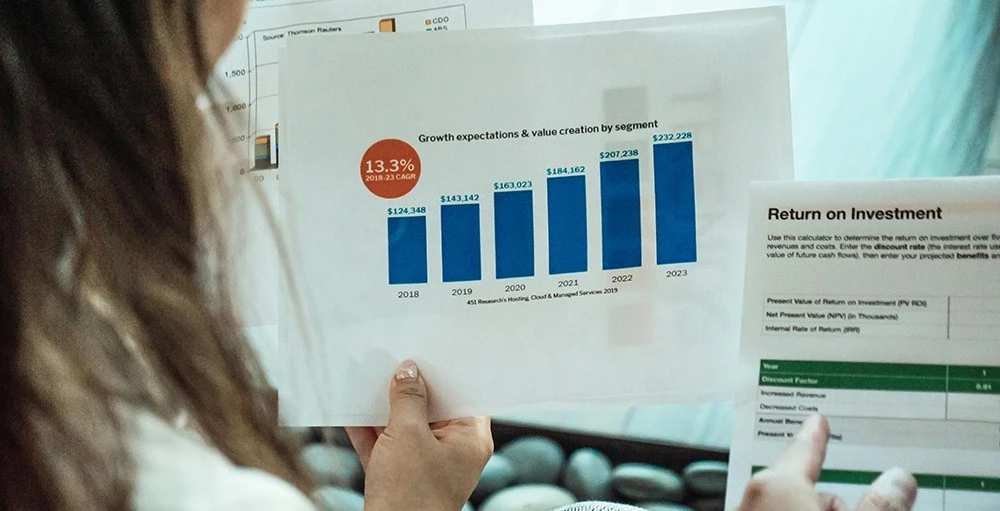

Many students view crypto investments as a way to diversify their portfolios and gain exposure to innovative technologies. Some use cryptocurrencies for everyday transactions, leveraging the convenience of digital wallets and blockchain-based payment systems. Others participate in decentralized finance (DeFi) protocols, exploring lending, borrowing, and yield farming opportunities.

Financial Risks and Benefits

However, alongside the promise of financial rewards, students face significant risks when dabbling in the crypto market. Volatility remains a hallmark of cryptocurrencies, with prices capable of soaring to dizzying heights or plummeting just as quickly. For students with limited financial resources, investing in crypto can lead to substantial losses if proper risk management strategies are not employed.

Moreover, the decentralized and largely unregulated nature of the crypto market exposes investors to scams, fraud, and cybersecurity threats. Without adequate knowledge and precautions, students may fall victim to phishing attacks, Ponzi schemes, or fraudulent initial coin offerings (ICOs), jeopardizing their financial security and well-being.

Despite these risks, cryptocurrencies offer several potential benefits for students. By engaging with crypto, students gain valuable insights into emerging technologies, blockchain governance models, and financial markets. They develop critical thinking skills, learn about risk management, and become more adept at navigating the complexities of modern finance.

Additionally, crypto investments can serve as a hedge against inflation and currency devaluation, especially in regions plagued by economic instability. For students from underserved communities or countries with limited access to traditional banking services, cryptocurrencies offer some hope for financial inclusion and economic empowerment.

Addressing Financial Literacy and Risk Management

Recognizing the growing importance of crypto in student finances, universities have a responsibility to incorporate relevant education and support mechanisms into their programs. By integrating cryptocurrency and blockchain technology courses into the curriculum, institutions can equip students with the knowledge and skills needed to navigate the complexities of the digital economy responsibly.

Furthermore, universities can establish dedicated centers or initiatives focused on financial literacy, investment education, and blockchain research. These centers can serve as hubs for interdisciplinary collaboration, fostering dialogue between students, faculty, industry experts, and policymakers.

Beyond academic offerings, universities can provide students with access to reputable resources, workshops, and mentorship programs focused on crypto investing and risk management. By promoting responsible investing practices and cybersecurity awareness, institutions can help students mitigate potential financial pitfalls and protect their assets from malicious actors.

The Role of Higher Ed

The rise of cryptocurrencies has transformed the financial landscape, presenting both opportunities and challenges for students on college campuses. While the allure of crypto investments is undeniable, students must approach the market with caution and informed decision-making.

Universities play a pivotal role in supporting students as they navigate the complexities of the crypto ecosystem. By integrating relevant education, fostering interdisciplinary collaboration, and promoting responsible investing practices, institutions can empower students to harness the potential of cryptocurrencies while safeguarding their financial well-being.

As the crypto revolution continues to unfold, it is essential for universities to adapt and evolve, ensuring that students are equipped with the knowledge, skills, and resources needed to thrive in an increasingly digital and decentralized world.