Financial Wellness for Student-Athletes

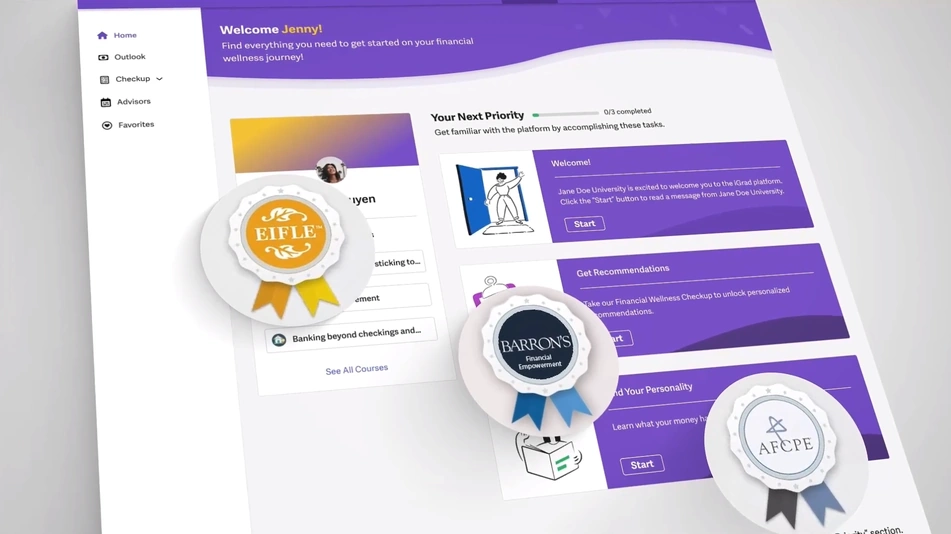

iGrad is a customizable financial wellness platform designed for colleges and universities to support the financial well-being of their student-athletes.

Empowering student-athletes to manage their money effectively.

Throughout the years, we’ve partnered with the NCAA and many athletic programs, helping to increase athlete retention rates and empower student-athletes to make smart financial decisions.

Our innovative platform is designed to provide comprehensive financial wellness support to student-athletes. It’s customizable and flexible, allowing colleges and universities to tailor the program to their specific needs.

Athlete-centric online course topics with an NIL focus.

Tailored curriculum for different needs and year levels.

LMS and Student Portal integration allows access from anywhere.

Empower Your Student-Athletes: Champion Their Financial Wellness

As an athletic director, you understand the immense pressure student-athletes face. They dedicate themselves to academics and excel in their sport, but are they prepared for the financial realities of life after graduation? By offering a comprehensive financial wellness program, you can:

Reduce stress and distractions: Help athletes focus on their performance by alleviating financial anxieties.

Promote responsible money management: Equip them with budgeting and savings skills for lifelong financial security.

Prepare them for life after athletics: Guide them toward career planning and smart financial decisions.

Enhance your department's reputation: Showcase your commitment to holistic athlete development.

Our financial wellness program for student-athletes offers interactive tools and resources that teach them how to manage their finances, understand their tax obligations, and plan for a secure financial future.

Platform Features & Functionality

Athlete-Centric Content

Content topics focused on personal branding, taxes, entrepreneurship, social media, financial wellness, career readiness, and NIL compliance.

Interactive Activities

Interactive tools, calculators, videos, webinars, and more!

Mindfulness Hub

Targeted journal prompts that tie into mindfulness and stress management around finances

Financial Assessments

Access to our proprietary financial stress assessment and Your Money Personality™ assessment.

Workshops

In-person and virtual workshops focused on engaging project-based and hands-on learning with student-athletes.

Financial Coaching

Access to our certified financial coaches and counselors to provide a human element and help keep students on track.

Investing in Your Athletes' Financial Future

Investing in the well-being of your student-athletes goes beyond the field. Partner with us to equip them with the financial literacy tools to succeed in life. Get started today with a demo.

Tiffany Jackson, Director, Student Financial Wellness Center, University of Kentucky

University of Kentucky

-

The Enrich product was recognized as a Barron’s Celebrates: Financial Empowerment honoree in Barron’s inaugural 2021 awards ceremony. "The organizations honored by Barron's Celebrates are having a meaningful impact in addressing financial literacy, and financial health and security in the U.S.,” said Dave Pettit, managing editor of Barron's Group.

Financial Empowerment Award

Barron’s Celebrates

-

Established in 2007, the mission of the Excellence In Financial Literacy Education (EIFLE) Awards is to promote the effective delivery of consumer financial products, services and education by acknowledging the accomplishments of those that advance financial literacy education.

Education Program of the Year

Institute of Financial Literacy

-

The annual award is given to a company or agency that displays scope, timeliness and scholarship in its approach to financial literacy, and provides information useful to those working in the field of financial counseling and planning.

Outstanding Consumer Info

AFCPE Award