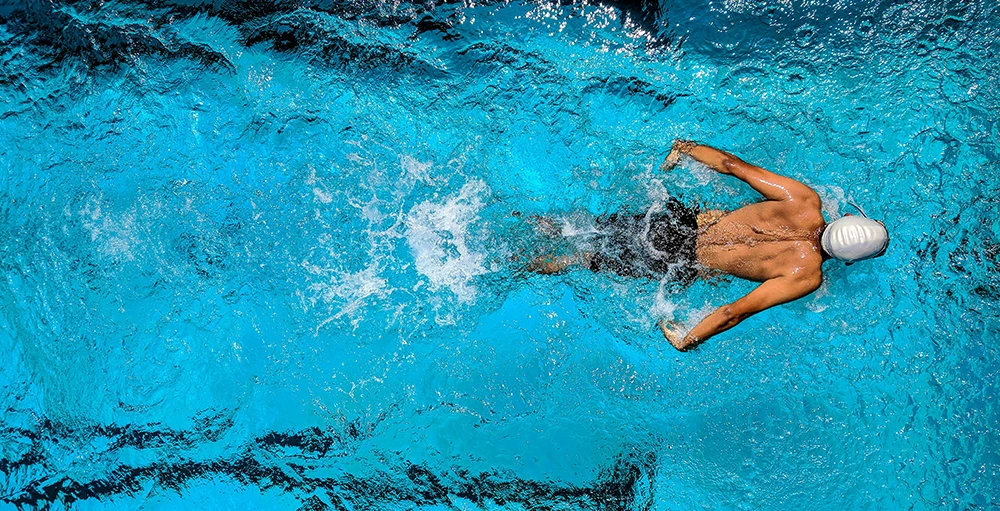

The cheers of the crowd, the thrill of competition – college athletics offer an unforgettable experience. But let's face it, the roar of the stadium fades eventually. While many dream of going pro, the reality is that a significant portion of student-athletes face financial struggles after graduation.

Did you know that according to studies, up to 86% of Division I athletes live below the federal poverty line1, despite the billions generated by college sports programs? Even with scholarships, many student-athletes juggle intense training schedules with academics, leaving little time for part-time jobs or financial planning.

Here at iGrad, we understand the unique challenges student-athletes face. That's why we created a comprehensive financial literacy program designed to empower students-athletes for success, both on and off the field. Here are some key strategies to get them started:

- Embrace Budgeting: Living on a budget may seem restrictive, but it's the foundation of financial stability. Track your income, including any NIL earnings, and create a plan for essential expenses like housing, food, and textbooks. There are plenty of budgeting apps available to help you manage your money effectively.

- Beware the Lifestyle Creep: With newfound earning potential through NIL, it's tempting to splurge. Resist the urge to keep up with appearances. Develop healthy spending habits and prioritize saving for the future.

- Plan for Taxes: Those NIL earnings are taxable income. Don't get caught off guard by a hefty tax bill at the end of the year. Talk to a qualified financial advisor about tax planning strategies.

- Invest in Yourself: While athletics are a priority, don't neglect your academic career. Explore career options that align with your interests and consider internships or volunteer opportunities to gain valuable experience.

- Seek Guidance: Don't be afraid to ask for help! iGrad offers workshops and connects you with mentors who can provide personalized financial guidance. Utilize the resources available to you and learn from financial experts.

Financial well-being is a marathon, not a sprint. By taking control of your finances today, you'll be well-equipped to navigate life after college, regardless of your athletic path.

Ready to take charge of your financial future? Contact iGrad today and explore our program designed specifically for student-athletes. We'll help you develop financial literacy, set realistic goals, and build a secure future beyond the playing field.

1 - Study College Athletes Worth Six Figures Live Below Federal Poverty Line, Drexel