The Programme for International Student Assessment (PISA) conducts educational surveys every three years that focus on a country's performance in each of three categories: mathematics, reading, and science. The survey focuses on a narrow section of students ranging from 15 years to 16 years old who have received at least six years of formal education.

Testing 510,000 students in 65 countries or economies, the most recent 2012 PISA survey focused on mathematics. Among those students, 85,000 of them in 18 countries, including the U.S., took an additional assessment on financial literacy. The financial literacy test ran for two hours and included both multiple choice and open-ended questions. The results included not only scores, but also information about each student's cultural, educational, and socioeconomic background.

Testing 510,000 students in 65 countries or economies, the most recent 2012 PISA survey focused on mathematics. Among those students, 85,000 of them in 18 countries, including the U.S., took an additional assessment on financial literacy. The financial literacy test ran for two hours and included both multiple choice and open-ended questions. The results included not only scores, but also information about each student's cultural, educational, and socioeconomic background.

The scores for U.S. students paint a stark picture of the state of U.S. financial literacy education in the 21st century.

Comparing Scores

The United States, and particularly Education Secretary Arne Duncan, has identified stronger financial literacy as a clear policy goal. This is in direct reaction to the number of adults lacking basic financial literacy skills, which continues to concern and stall a still-recovering U.S. economy.

Yet despite this knowledge, the financial literacy scores for U.S. students ranked internationally remain average, and a bit below average at that. Here are some highlights from the PISA assessment:

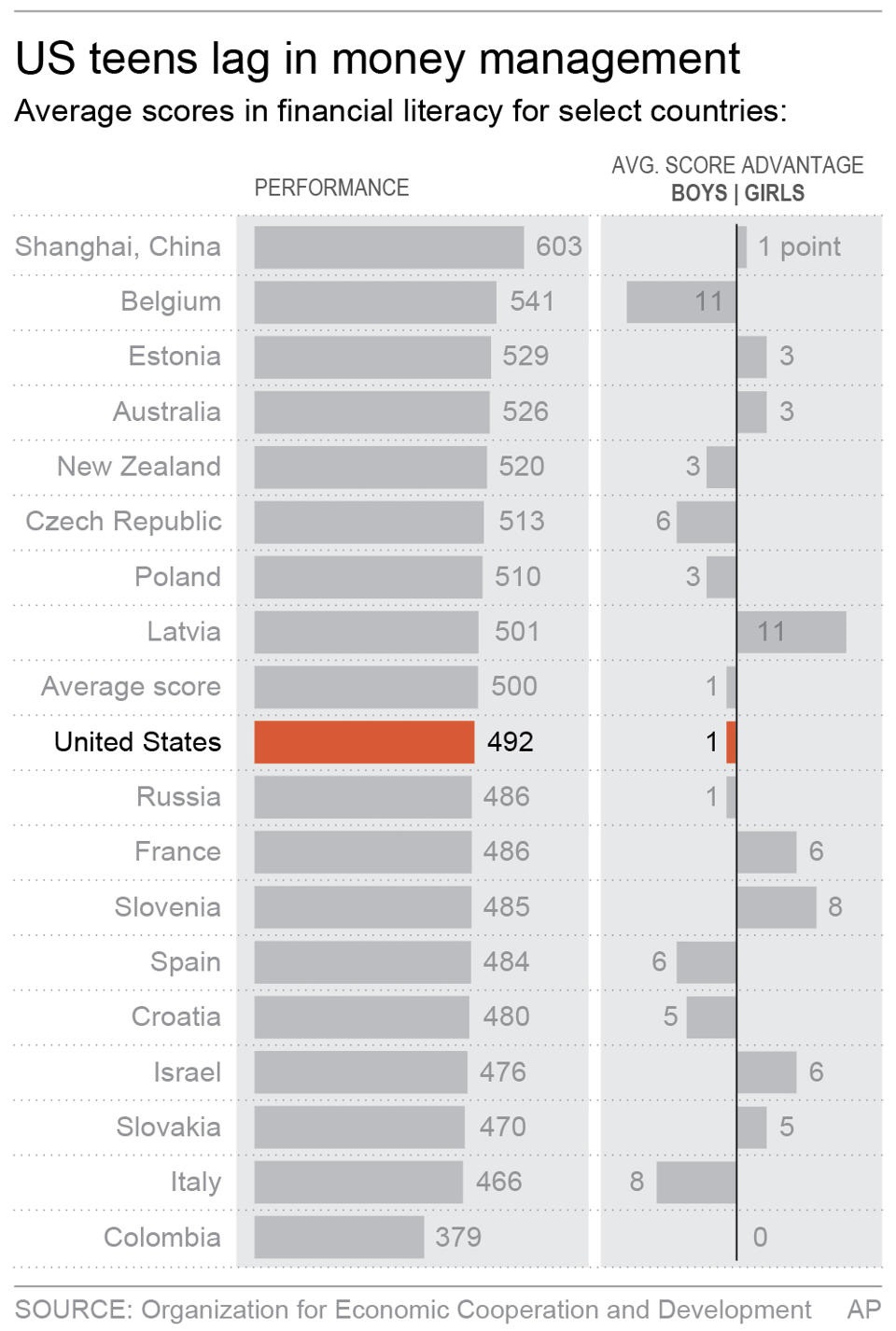

- The U.S. ranked 9 out of 18 participating countries.

- The mean score on the PISA assessment for U.S. students was 492. The international average was a slightly higher 500.

- The international average for students scoring at the bottom level of financial literacy (Level 1) was 14.6%, but 16.8% of students in the United States scored Level 1.

- On the upper end, 19.5% of U.S. students performed at Level 5, compared to 21.2% internationally.

- The number one country, the Shanghai region in China, had 63.5% of students score Level 5 and only 1.5% score Level 1.

The financial literacy of adults has a clear correlation with their education, income, and overall wealth. However, when assessing the ability of young adults and teens to make financial decisions, additional factors, including the educational system, play a clear role. The success of Shanghai students proves that a focus on finance and thus financial literacy as an integral part of a student's education has a positive effect. There is nothing "special" about students in China, they are simply taught differently than students elsewhere.

The failure of U.S. students to score at the highest levels of financial literacy is therefore as much a concern to educators as it is to parents. Luckily, there are steps that educators and parents can take to encourage financial literacy. This includes not only consciously teaching it and including it in universal curriculums and general education, but creating an environment at the micro level which promotes financial literacy as an essential life skill akin to reading and writing.

There are simple ways to so this. One of the most significant conclusions of this PISA study was that there is a direct correlation between high-performing school systems and the equitable distribution of educational resources across socioeconomic groups. Another correlation exists between high scores and educational environments where teachers and administrators believe in their students' ability to score at the highest levels, and who subsequently encourage their students to engage in their education as stakeholders.

[Read: How Do We Make Financial Literacy Education More Effective?]

While the United States sits squarely in the middle of the PISA scores, keeping our global position as a financial leader demands that these scores increase. Otherwise, the next generation of economic players will not have the skills they need to maintain that position globally as well as within their own homes.