Studies show that the majority of college students experience financial stress no matter what the state of the economy.

The Student Financial Wellness Survey1 found that:

- 65 percent worry about paying tuition

- 1 out of 4 students do not know how they will pay for the following semester

- 53 percent worry about meeting monthly obligations

- 77 percent have run out of money in the past year, with 34 percent running out five or more times

- 58 percent feel they more student loan debt than they expected

- 68 percent are not confident they will be able to pay off their student loan debt

Student financial stress also impacts the colleges and universities they attend.

How Financial Stress Affects Colleges and Universities

Multiple studies have shown that those experiencing financial stress:

- Study less – 32 percent2

- Drop classes – 34.2 percent3

- Reduce to part-time enrollment – 34.2 percent3

- Drop out of school – 16 percent4

- Transfer to a different institution – 13 percent2

Lack of Emergency Savings Affects Students

Overall, the biggest sources of financial stress revolve around making financial decisions. According to a Money Matters survey5, the top three include:

- Finding a job after graduation

- Tuition hikes

- Having enough money to last the semester

One reason that students worry about money is that they don’t have any money put away in case of an emergency. Nearly two-thirds (63 percent) of college students state they do not have access to $500 if something came up.1

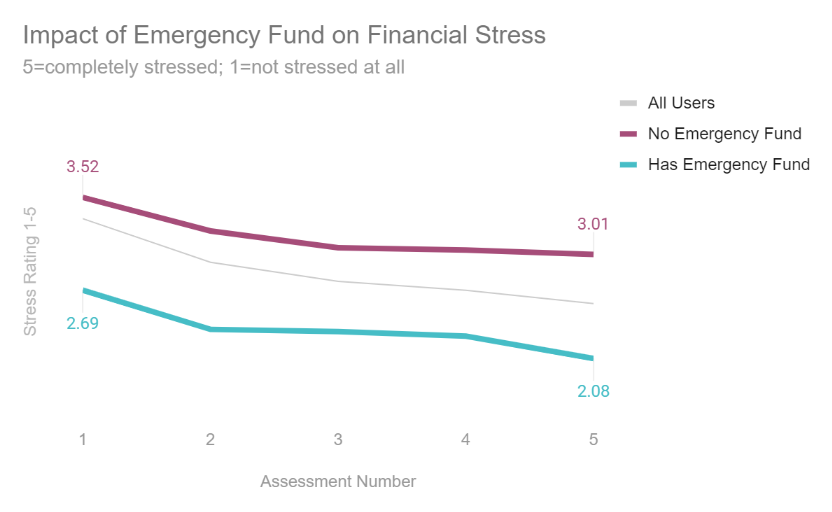

At iGrad, our data shows that having at least three months of living expenses in an emergency savings account greatly reduces financial stress.

[Student financial stress goes down over time when using the iGrad Financial Wellness program, with those that have at least a 3-month emergency savings fund exhibiting the lowest stress levels.]

Simply having an emergency fund, even if the student’s financial assessment number is low, has a significant bearing on the amount of stress they feel.

Adding a Student Financial Literacy Program Can Help

Many students feel that they get the help they need from their school:

- 28 percent feel their school is not actively working to help them reduce their financial challenges1

- 29 percent feel that the faculty understands their financial situation1

Unfortunately, many higher education institutions do not offer financial literacy education beyond what is required for those taking out student loans through the financial aid office.

Instead of prescribed student loan information, students need a holistic financial literacy program that provides them with the appropriate information and personalized tools to become financially well.

A recent Financial Industry Regulatory Authority (FINRA) study showed that student financial literacy programs can have a positive effect.6

By looking at students with mandated financial education and those without, the study found that those with access to financial literacy programs have:

- Higher credit scores

- Fewer delinquent credit card payments

- More savings

- Lower credit card balances

- The ability to make and stick to a budget

For institutions that integrated financial literacy into their overall curriculum, bottom-line results were seen as well: higher retention and increased graduation rates.

Three Things To Do To Encourage Emergency Savings

Since having emergency savings reduces stress, financial wellness programs should help students learn how to create a personal “rainy day” fund.

To do this effectively, the program should focus on three key strategies: Increasing money coming in, decreasing money going out and correcting bad habits.

Teach Smart Spending: The goal of smart spending is to put money away into a savings account instead of spending it on frivolous items.

This begins with the creation of a budget making a personalized, interactive budgeting tool a necessary component of any financial literacy program.

This can help students keep from overspending on things they don’t have to have, such as a new smartphone, as well as over-indulging on things they enjoy, such as going to bars or restaurants.

Learning to create and stay within a budget will help students keep from running through their money – whether it is their own money or financial aid funds – before the semester ends.

Teach Savings Habits: Students should begin the saving habit, even if they can only save a small amount each semester.

The right financial literacy program will offer tips for making small steps to get in the habit, such as making a budget, opening up a dedicated savings account, taking advantage of student deals, eating in rather than eating out, and more.

Find Part-time Jobs or Side Gigs: Part of financial wellness is helping students find employment that can offset tuition or provide money for other expenses.

Students should be encouraged to save a portion of their earnings, between 5 and 10 percent, in a dedicated savings account.

The key is for the student to find a job that fits easily within their schedule.

Jobs that conflict with a student’s course load increases the likelihood of dropping classes or postponing education altogether.

However, studies show that having the right part-time job helps students manage their schedules, procrastinate less, and get better grades.7

1 - https://www.trelliscompany.org/wp-content/uploads/2019/06/Fall-2018-SFWS-Report.pdf

2 - https://news.osu.edu/70-percent-of-college-students-stressed-about-finances/

3 - https://www.acha.org/documents/ncha/NCHA-II_SPRING_2019_US_REFERENCE_GROUP_EXECUTIVE_SUMMARY.pdf

4 - https://lendedu.com/blog/college-dropouts-student-loan-debt/

5 - https://everfi.com/wp-content/uploads/2019/05/MoneyMatters-2019.pdf

6 - https://www.usfinancialcapability.org/downloads/NFCS_2018_Report_Natl_Findings.pdf

7 - https://nces.ed.gov/pubs94/94311.pdf